how much is the 3rd loan in gloan|GCASH Offers Loan Options: How To Apply For GLoan : Cebu GLoan Sakto is GCash's fast and easy cash loan solution where you can loan PHP 100 - PHP 300 instantly. If you are new to borrowing money, this is a good .

Hip Replacement Surgery Hip replacement surgery is a common and highly- successful orthopedic treatment for severe hip osteoarthritis and other conditions which lead to degenerative changes of the hip joint. The procedure involves removal of the degenerative parts of the hip, and replacement with a prosthetic device. . Greenwich, Harrison .

PH0 · How To Loan in GCash: Complete Guide to GLoan, GGives, and GCredit

PH1 · How To Loan in GCash: Complete Guide to GLoan, GGives, and

PH2 · How To Loan In GCash With GLoan 2024: 6 Easy Steps

PH3 · How To Loan In GCash With GLoan 2024: 6 Easy

PH4 · GLoan: Actual Cash Loans in GCash

PH5 · GLoan, GGives, and GCredit: How to Avail of a Loan in GCash

PH6 · GLoan – GCash

PH7 · GLoan Sakto Loan – GCash Help Center

PH8 · GLoan Overview – GCash Help Center

PH9 · GLoan Interest & Fees – GCash Help Center

PH10 · GCash Loans: GLoan, GGives, and GCredit

PH11 · GCASH Offers Loan Options: How To Apply For GLoan

And now, CAC makes history by being the first Filipino aggregates company to obtain an ISO 9001-2000 certification. This is a Quality Management System Standard given to corporations that meet the international standards of excellence. CAC is a company that is never behind the times.

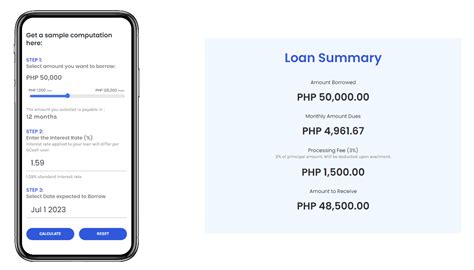

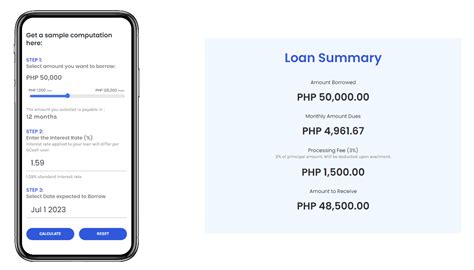

how much is the 3rd loan in gloan*******Find out more about GLoan below: Loanable Amount. PHP 1,000 - PHP 125, 000. Payment Terms. Monthly payment: 5, 6, 9, 12, 15, 18, 24 mos. Interest Rates. 1.59% - 6.99% per month. *depending on your eligibility and selected payment term.how much is the 3rd loan in gloanGLoan Interest & Fees. Read in Taglish. Updated 2 months ago minute read. .

GLoan Sakto is GCash's fast and easy cash loan solution where you can loan PHP .

GLoan Interest & Fees. Read in Taglish. Updated 2 months ago minute read. Check out the following Interests and Fees with GLoan below: Interest fees. .

GLoan is a lending feature for GCash users. You can get an emergency loan in GCash and borrow up to ₱125,000. Receive the proceeds of this online loan through . GLoan Sakto is GCash's fast and easy cash loan solution where you can loan PHP 100 - PHP 300 instantly. If you are new to borrowing money, this is a good . GCASH offers loan options for up to Php25,000, with flexible terms up and payable for up to 12 months. It’s available for an interest rate of 2.59% to 2.89% (depending on the loan amount) and has a .

GLoan lets you borrow cash easily and conveniently with GCash. Learn how to apply, manage, and pay your GLoan with the GCash Help Center.

How much can I avail with GLoan and what are the terms? The general terms of the loan depend on your GScore. There are two types of GLoan: the normal GLoan, and the Sakto Loan. The normal GLoan .Credits: GCash. GLoan is a personal cash loan service that can be accessed directly through the GCash app. This guide will provide you with a step-by-step process on how to avail of GLoan, as well as important .

Table of Contents. How to Loan in GCash: Step-by-Step Process. What is GCash Loan or GLoan? What are the GCash loan requirements? What is the GCash loan interest rate? How Can I .

All currently employed, currently contributing self-employed or voluntary member. For a one-month loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.; For a two-month loan, the member-borrower must have seventy two (72) .

how much is the 3rd loan in gloan GCASH Offers Loan Options: How To Apply For GLoan Eligibility for GLoan. Updated 2 months ago minute read. You are eligible to start using GLoan when you qualify for all of the requirements below: 21-65 years old. A Filipino citizen. A Fully Verified GCash user. Maintain a good credit record and did not commit any fraudulent transactions. To unlock GLoan, continue using GCash services .The loan is payable within three years or 36 months and comes with a deferred first payment. Members may also opt to pay their loans in two years or 24 months. If you are an employed member, you may pay your loan amortizations via a salary deduction arrangement with your employer. Should you wish to accelerate or advance your .

GLoan has a maximum loanable amount of up to P125,000. All loan applications are subject to the approval of the platform. Once approved, the money will go straight to your GCash wallet. The amount borrowed is payable up to 24 months. GCash guarantees its clients that there are no hidden charges under its loan offer.Get money. APR 59.9%. ₱1,000 — ₱25,000. from 2 to 6 months. 21 — 70 years. SEC Registration No. 202003056. Certificate of Authority No. 1272. Get money. Calculate your monthly loan payments and total interest with our easy-to-use credit calculator.36 months. 1.25%. 25.976%. Basic fees and charges for Personal Loan: Disbursement Fee - Php 1,500. Documentary Stamp Tax - Php 1.50 for every Php 200 of the loan amount (for loans above Php 250,000) Late Payment Fee - Php 850 per incidence of late payment or non-payment. Pre-termination Fee - 5% of Outstanding Balance or Php 550, whichever .

Lenders charge a personal loan penalty fee of 3% to 8% of the overdue amount or ₱500 per month, whichever is higher. For example, you have a BPI personal loan and missed a payment for a month. You’ll need to pay a late payment fee of 5%. If your unpaid balance is ₱1,000, your loan penalty charge is ₱50. The loanable amount varies according to the user's eligibility. GCash now offers up to PHP 125,000 loan amount via GLoan, depending on your GScore. To recap, GLoan is a personal cash loan straight from the GCash app. Before the maximum amount, you may borrow is PHP 50K but the e-wallet company bumped it to a six-digit amount. The minimum amount is Php 1000 and the maximum is Php 125000. The loan duration can vary from 5, 6, 9, 12, 15, 18, and 24 months. The add-on interest rate is 1.59-6.57% per month. There is a 3% fee outright when you get the loan. GLoan Sakto Loan terms are: The minimum amount is Php 100 to Php 500. How much is BillEase Loan? BillEase lets you borrow loans going from ₱2,000 up to 40,000 pesos with installments going from 1 month up to 12 month. You can use the money for online shopping even if you don’t own a credit card. Interest rate . BillEase charges the lowest interest rate which is only 3.49% monthly.

How much can I loan in GLoan GCash? The purchase loan in GLoan differs for each GCash user. But typically, you can borrow around P1,000 for the minimum and up to P50,000. GCash also charges .The Salary Loan is a short-term loan made available to SSS members who are currently employed and paying their monthly contributions. The loan amount is based on the member’s contribution record and salary. The maximum loadable amount is P20,000 while the minimum is P1,000. Shopee offers loan terms of 3, 6, 9, and 12 months. The 12-month Shopee loan instalment is offered to eligible Shopee users only. An installment loan can be a great option if you need cash fast but don't .For two-month loan: 72 monthly contributions, six (6) of which should have been posted in the last twelve (12) months prior to the month of application. If employed, the member’s employer must be updated in the payment of contributions and loans. The member must also be updated in the payment of other loans with SSS. .☑ Active member with least 24 months savings: ☑ Not more than 65 years old at the date of loan application and is not more than 70 years old at the date of loan maturity: ☑ Legal capacity to acquire and encumber real property: ☑ No Pag-IBIG housing loan foreclosed, cancelled, bought back, or voluntarily surrendered: ☑ If with existing Pag-IBIG Housing . To qualify for a Pag-IBIG Multi-Purpose Loan, Pag-IBIG Fund members need to meet the following requirements: Have a total Pag-IBIG Fund savings of ₱4,800 or at least 24 monthly Membership Savings (MS) Have made at least one Membership Savings within the last six months, as of the month prior to the date of loan application.

Multi-Purpose Loan (MPL) Plus. MPL Plus is the enhanced MPL program that gives active members an additional credit line that will help them consolidate and settle their outstanding GSIS loan balances. Depending on their employment status, periods with paid premiums (PPP), and basic monthly salary (BMS), loan borrowers may apply for up to .GCASH Offers Loan Options: How To Apply For GLoan Multi-Purpose Loan (MPL) Plus. MPL Plus is the enhanced MPL program that gives active members an additional credit line that will help them consolidate and settle their outstanding GSIS loan balances. Depending on their employment status, periods with paid premiums (PPP), and basic monthly salary (BMS), loan borrowers may apply for up to .month, or about 0.5 percent per day for covered loans which are unsecured, general-purpose loans that do not exceed the amount of P10,000 and with a loan tenor of up to four months. The EIR is expressed as the rate that exactly discounts estimated future cash flows throughout the life of the loan to the net amount of loan proceeds. It includes the

Watch: Underscoring the government's commitment of enhancing the skills of the Filipino workforce to foster local empowerment and global competitiveness, the Technical Education and Skills Development Authority (TESDA) kicks off a weeklong celebration of its 30th founding anniversary at the World Trade Center in Pasay City on August 19, 2024.

how much is the 3rd loan in gloan|GCASH Offers Loan Options: How To Apply For GLoan